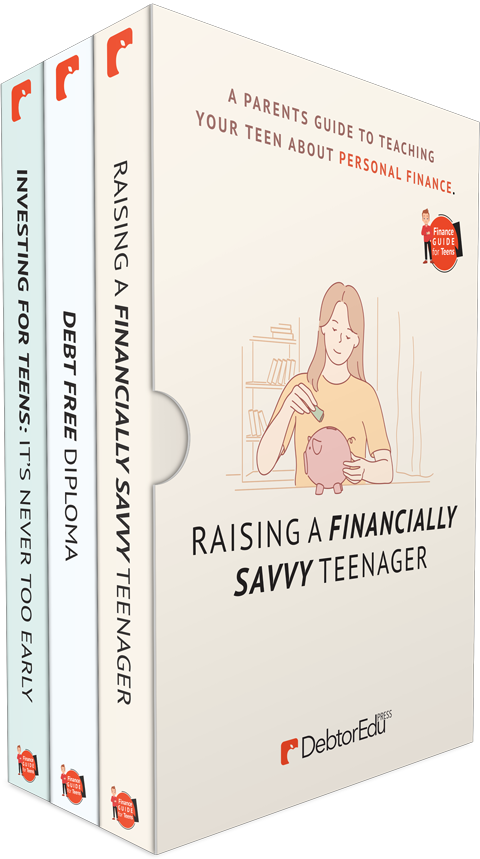

Finance Education for Teens: 3-Book Bundle

Set your teen up for financial success now with our comprehensive, step-by-step finance guides!

Set your teen up for financial success now with our comprehensive, step-by-step finance guides!

Description

Trying to teach your teen about personal finance? It’s not always the easiest task. You might even be working on becoming financially savvy yourself. But it’s important to pave the way for your teen now. Many teenagers don’t receive the financial education they need to survive on their own. They need guidance. Thankfully though, you don’t have to go at it alone.

That’s why we’re offering this 3-book bundle to help you educate your teenager about all things finance. From paying for college to creating passive income through investing, these books provide the expertise and know-how you need to share with your teen about becoming a financially responsible adult.

Here are the books you’ll receive:

Set your teenager up for financial success -- BEFORE they go into debt. This book bundle helps you do just that!

Product Details

| Pages | 45 |

|---|---|

| Format | Hardcover |

| Language | English |

| Size | A6 |

| Package Content | 1 x Raising a Financially Savvy Teenager 1 x Debt Free Diploma 1 x Investing for Teens It's Never Too Early |

| Category | Finance |

Have Questions? Call 1 (800) 610-3920. Monday - Friday: 9am to Midnight EST Saturday - Sunday: 9am to 5pm EST

© 001 DebtorCC Inc. All Rights Reserved.

Our Address: 378 Summit Ave. Jersey City NJ 07306.